It is proposed to exempt SMEs from taxes for two years in Kazakhstan

This amendment provides improvement of tax policy, contributing to the simplification of doing business and attracting investment in Kazakhstan.

Entrepreneurs will save about 40 billion tenge with a retail tax of 3%.

The new tax will be especially beneficial in industries where the main cost is the labor fund.

It is noted that if the VAT threshold is raised, the new tax will not be paid.

According to the Ministry of National Economy of the Republic of Kazakhstan, the special regime will affect 4 thousand SMEs, which can save about 40 billion tenge.

Meet the Associate | ACIK Stories: FBM

Meet the Associate | ACIK Stories: FBM

TECNIMONT reassures: “Our projects in Kazakhstan are proceeding as planned”

TECNIMONT reassures: “Our projects in Kazakhstan are proceeding as planned”

Meet the Associate | ACIK Stories: Neway Valve

Meet the Associate | ACIK Stories: Neway Valve

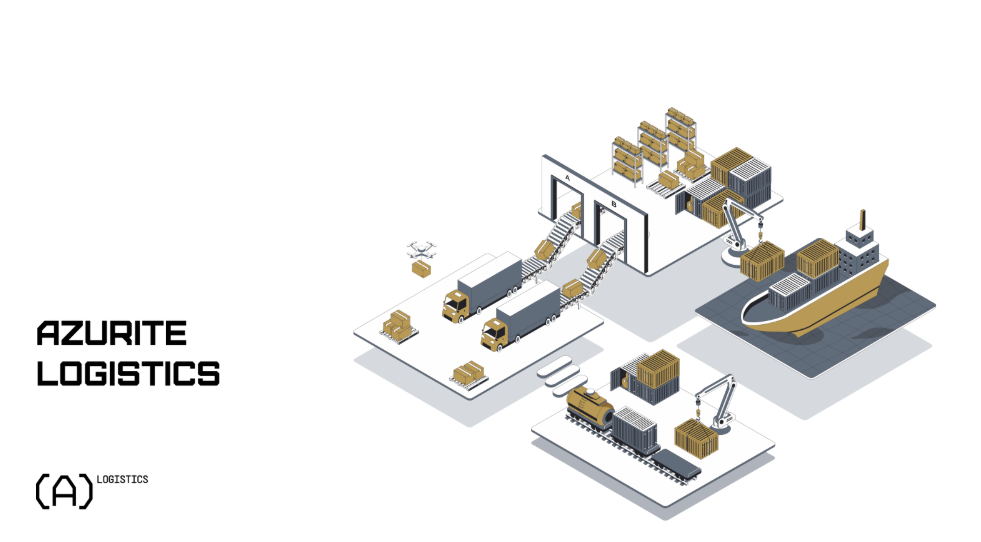

Meet the Associate | ACIK Stories: Azurite Logistics

Meet the Associate | ACIK Stories: Azurite Logistics

Meet the Associate | ACIK Stories: KZ Protection Group

Meet the Associate | ACIK Stories: KZ Protection Group

ACIK and President Marco Beretta Take Center Stage in Rome Meeting with Kazakhstan’s Minister of Foreign Affairs

ACIK and President Marco Beretta Take Center Stage in Rome Meeting with Kazakhstan’s Minister of Foreign Affairs

Meet the Associate | ACIK Stories: AER

Meet the Associate | ACIK Stories: AER

President Mattarella in Astana: A Renewed Bond with the Italian Community and Kazakhstan

President Mattarella in Astana: A Renewed Bond with the Italian Community and Kazakhstan