ACIK Focus: SMEs in Kazakhstan by Tommaso Aguzzi

Tommaso Aguzzi is a Ph.D. Candidate in Business Administration within the EU-funded MARKETS programme (Grant ID: 861034) at Tallinn University of Technology (TalTech). His research delves into the realm of informal economy practices among SMEs and the construction of social norms with a particular focus on Kazakhstan's economy and society. Beyond his academic work, he develops documentary photography projects that shed light on the rich social and cultural tapestry of the post-Soviet space. Additionally, he extends his expertise as a professional travel guide in Central Asia and Caucasus, offering travelers an enriching exploration of these regions.

Small Entrepreneurship in Kazakhstan: Trading Between Light and Shadow

Kazakhstan, a vast and diverse nation in Central Asia, has witnessed significant economic transformation since gaining independence in 1991. One of the key drivers of this transformation has been the emergence and growth of small and medium-sized enterprises (SMEs). In this article, I delve into the world of small entrepreneurship in Kazakhstan, shedding light on its contributions to the economy, its challenges, and the intricate dance between formal and informal sectors.

The SME Landscape in Kazakhstan

Small and medium-sized enterprises, commonly referred to as SMEs, have become the lifeblood of Kazakhstan's economy. The street sellers, shuttle traders (so-called chelnoki), and improvised flea markets of the chaotic and harsh nineties progressively transformed into small entrepreneurs, traders involved in international trades and networks, and claimed their retailing spaces in bazaars and shopping malls throughout the country. Today, these enterprises play a pivotal role in generating employment, fostering innovation, and contributing to the country's gross domestic product (GDP). According to the most recent data, Kazakhstan has experienced a consistent rise in the number of operational SMEs over the past decade, with the count now exceeding 1.8 million. This figure alone indicates the significance of small entrepreneurship in the nation's economic fabric.

Kazakhstan's SMEs also serve as a vital source of employment. More than 40% of the total employed population in the country derive their livelihoods from SMEs. This statistic showcases how SMEs have become instrumental in providing jobs and livelihoods to millions of Kazakhstani citizens. When it comes to their economic contributions, SMEs have a substantial impact on Kazakhstan's GDP. In the year 2022, these enterprises collectively contributed 36.5% of the country's GDP. Despite the adversities faced by small business owners during the peak of the global COVID-19 pandemic, the entrepreneurial sector showed resilience and progressively recovered over the last year, returning to pre-pandemic turnovers.

The Business Environment in Kazakhstan

The trajectory of SMEs in Kazakhstan has been on a remarkable upward trajectory until the global pandemic crisis. In 2021, the total number of citizens employed in SMEs increased by 10.6% compared to the previous year, reaching a total of 3.5 million people. This growth is not only promising for the individuals who find employment in SMEs but also for the broader Kazakhstani economy, as it bolsters consumer spending, investment, and economic stability. The success of SMEs in Kazakhstan can be attributed, in part, to the conducive business environment fostered by the government. The nation has implemented a range of policies and initiatives aimed at promoting small entrepreneurship. These include financial incentives, streamlined regulations, and support services designed to facilitate the growth of SMEs.

The Kazakhstani government has recognized the importance of SMEs and has introduced various programs to support their development. Financial support measures, such as loans and grants, are made available to SMEs to help them overcome initial hurdles and sustain their operations. Additionally, the government has initiated efforts to simplify bureaucratic procedures, making it easier for entrepreneurs to start and operate their businesses. More can be done in terms of investments in infrastructure to support SMEs, such as internet connectivity and delivery services to support e-commerce and digital entrepreneurship, allowing SMEs to tap into global markets. Recognizing that human capital is a critical factor in the success of SMEs, Kazakhstan has invested in education and skill development programs. These initiatives aim to equip entrepreneurs with the knowledge and tools needed to navigate the challenges of running a business successfully, promote financial literacy and support women entrepreneurship.

Challenges and Shadows of Small Entrepreneurship

Despite the promising landscape, small entrepreneurship in Kazakhstan is not without its challenges. One significant issue is the presence of a substantial informal sector that operates in parallel with the formal economy. This informality casts a shadow over the legitimate business environment and presents various obstacles. Informality in the context of small entrepreneurship refers to businesses that operate outside the purview of government regulations and taxation. While informality is not unique to Kazakhstan, it poses specific challenges to the growth and sustainability of SMEs in the country, and deprives the national budget of critical fiscal revenues.

The informal sector in Kazakhstan includes a range of activities, spanning from street vendors and small home-based businesses to enterprises that do not fully adhere to tax regulations. In an interview with a professional tax accountant specializing in small businesses, he pointed out that the retail sector, as well as the creative and pharmaceutical industries, witness a significant prevalence of informal transactions. These businesses often evade taxation and regulation, giving them a competitive advantage in terms of lower costs. However, this comes at the expense of lost government revenue and a lack of social protections for workers. One of the most significant challenges associated with informality is revenue leakage. When businesses operate in the informal sector, they often do not contribute their fair share of taxes to the state budget. These funds, if managed properly by the state, can be used to develop more efficient public services and infrastructures. Informality also creates an uneven playing field for formally registered SMEs that bear the main burden of taxation. Informal businesses tend to bypass labor regulations, leaving their employees without essential protections and benefits. This includes access to social security, health insurance, and legal recourse in case of workplace disputes. This lack of protections can lead to exploitative labour practices and hinder the overall wellbeing of workers.

Navigating the Informal-Formal Nexus

The presence of a large informal sector can create challenges for formally registered SMEs. These businesses often face competition from informal counterparts that can afford to offer lower prices due to their tax evasion. This dynamic can discourage formalization and hinder the growth of SMEs operating within the formal economy. To gain deeper insights into the dynamics of small entrepreneurship in Kazakhstan, it is essential to explore how businesses, both formal and informal, operate and coexist. Almaty, the largest city in Kazakhstan, serves as a microcosm of this intricate relationship, offering valuable insights into the challenges and opportunities faced by small business owners.

The Bazaar Experience

One of the most notable aspects of small entrepreneurship in Almaty is the prominence of bazaars. These bustling marketplaces are hubs of economic activity, where vendors sell a wide range of goods, from fresh produce to clothing and electronics. The so-called Baraholka bazaars and the Green Bazaar have historically been a focal point for small and micro entrepreneurial activities in Almaty. Yet, the entrepreneurial spirit that thrives within these vibrant markets often dances along the fringes of fiscal legality. Many business owners forego the rigors of formal financial record-keeping, eschewing cash transactions and electronic transfers via phone numbers in lieu of traditional methods. They operate as individual entrepreneurs without extending the umbrella of formal employment contracts, while others simply remain unregistered.

A few months ago, I had the opportunity to interview the Green Bazaar administrators, who gave us some precious insights into the present and future of this historical marketplace. The two administrators I interviewed were two “veterans” having worked at the Green Bazaar since 1997 and having experienced 8 different administrators succeeding over the years. The last one took charge in September 2022 and since then, he began a restructuring process which involved the administrative staff and the bazaar’s management strategy. The two admins described how, in a few months, he managed to create a more conducive work environment and a horizontal organisational culture where they feel treated fairly and as equals. In addition, the new administrator launched an ambitious modernization programme for the bazaar implementing renovations of the market’s facilities and surroundings to make it more accessible and “a venue which is not only for shopping”. The Green Bazaar is not just an economic powerhouse; it is a sprawling nexus comprising over 2,500 enterprises and providing gainful employment to more than 4,000 individuals, with women constituting a formidable 70% of this labor force. Administrators underscored their unwavering commitment to stringent food safety regulations and daily quality controls, ensuring that every customer is offered only high-quality products.

When inquired about the tax compliance of the business owners operating at the bazaar, they reassured me that tax evasion is always punished by administrative sanctions and that the state exerts control over the fiscal compliance of Green Bazaar’s businesses. However, it is interesting to observe that, from a customer's perspective, a majority of the vendors remain bereft of point-of-sale (POS) terminals, instead conducting transactions exclusively in cash or through online channels, facilitated primarily by the Kaspi.kz system and phone numbers. This shadowy financial ecosystem raises questions about how these entrepreneurs meticulously track their revenues and subsequently report them to the national tax authorities.

The Shopping Mall Alternative

In contrast to the informality of bazaars, shopping malls in Almaty offer a different avenue for small entrepreneurs. Many entrepreneurs choose to set up shop in these modern retail spaces, benefiting from the formalized environment and the assurance of legal protections. Shopping malls provide a stark contrast to the informal, open-air markets, with controlled environments and established business norms. Just a few weeks ago, we had the privilege of conversing with Erlan Mukashev, the visionary behind the Aport shopping and entertainment centers, Kazakhstan's largest mall conglomerate. Mr. Mukashev, along with his six brothers, has straddled the business realms of Canada and Kazakhstan for the past 15 years. Their inspiration for launching the Aport Mall in the western precincts of Almaty was ignited by the vibrant shopping centers they encountered in Edmonton, Alberta. Recognizing parallels between the two nations, such as continental climates, vast expanses of sparsely populated land, and burgeoning urban hubs, the Mukashev family believed this model could be seamlessly transplanted into Kazakhstan. The venture, tailored to cater to the growing middle-class families, proved resoundingly successful. The Aport Mall blossomed into a retail and entertainment juggernaut, boasting an impressive array of over 200 retail outlets, a state-of-the-art 7-hall cineplex, Central Asia's largest indoor aquapark, and a multifaceted educational and entertainment center for children. In addition to its remarkable amenities, the mall served as a job creation engine, offering more than 5,000 positions with competitive remuneration packages. Remarkably, it also played a pivotal role in the formalization of over 300 small and medium-sized enterprises, thanks to its accommodating rent structures tailored to bolster small entrepreneurs. When I inquired whether malls like his might eventually replace the traditional bazaars, Mr. Mukashev offered a nuanced perspective. He asserted that both bazaars and malls could not only coexist but thrive symbiotically in Kazakhstan's evolving retail landscape. In his estimation, a pressing challenge that warrants collective attention is the battle against counterfeiting—a concern that transcends the boundaries of both traditional and modern retail domains.

Bridging the Gap: Incentives, strengthening regulations and promoting collaboration

The coexistence of formal and informal small entrepreneurship in Kazakhstan poses both opportunities and challenges for the nation's economic development. To harness the full potential of SMEs and address the issues associated with informality, several strategies can be considered:

One approach to bridging the gap between formal and informal sectors is to provide incentives for informal businesses to formalize their operations. This could include simplified income tax return process, tax incentives, and access to support services that help informal entrepreneurs transition into the formal economy. Another strategy is to strengthen regulatory enforcement to ensure a level playing field for all businesses. This would involve cracking down on tax evasion, implementing fair labour practices, and enhancing consumer protections. Such measures can discourage businesses from operating in the shadows. Providing education and support to entrepreneurs can also make a significant difference. By offering training programs, financial literacy courses, and mentorship opportunities, small business owners can gain the knowledge and skills needed to succeed within the formal economy. Collaboration between formal and informal businesses can lead to mutually beneficial outcomes. Encouraging partnerships and linkages between different sectors of the economy can help informal businesses access formal markets while formal businesses can tap into the flexibility and innovation often associated with informality.

Small entrepreneurship in Kazakhstan has emerged as a powerhouse of economic growth, contributing significantly to employment, GDP, and innovation. However, the shadow of informality looms large, posing challenges that must be addressed to ensure the sustainable growth of SMEs. As we have seen through interviews with entrepreneurs and tax professionals in Almaty, both formal and informal small business owners face unique circumstances and trade-offs. Significant advancements have been made in streamlining the business registration process, resulting in a rising number of business entities officially registering their activities. Nevertheless, considerable work remains to be done in simplifying the income declaration procedure, improving financial literacy among entrepreneurs, and enhancing the skills and expertise of tax authority inspectors and public servants. Since gaining independence, the Kazakh government's implementation of neoliberal reforms and restructuring has led to a reduction in public employment and funding, while the explosive growth of the private sector necessitates a professional cadre of public servants to effectively regulate it. The key to fostering a thriving small business ecosystem in Kazakhstan lies in finding ways to bridge the gap between the formal and informal sectors, offering incentives for formalization, and strengthening regulatory frameworks. In doing so, Kazakhstan can continue to harness the immense potential of its small entrepreneurs, ensuring that they remain a driving force in the nation's economic development while simultaneously addressing the challenges posed by informality. The future of small entrepreneurship in Kazakhstan indeed lies in trading between light and shadow, and the nation's ability to strike the right balance will shape its economic landscape for years to come.

Meet the Associate | ACIK Stories: FBM

Meet the Associate | ACIK Stories: FBM

TECNIMONT reassures: “Our projects in Kazakhstan are proceeding as planned”

TECNIMONT reassures: “Our projects in Kazakhstan are proceeding as planned”

Meet the Associate | ACIK Stories: Neway Valve

Meet the Associate | ACIK Stories: Neway Valve

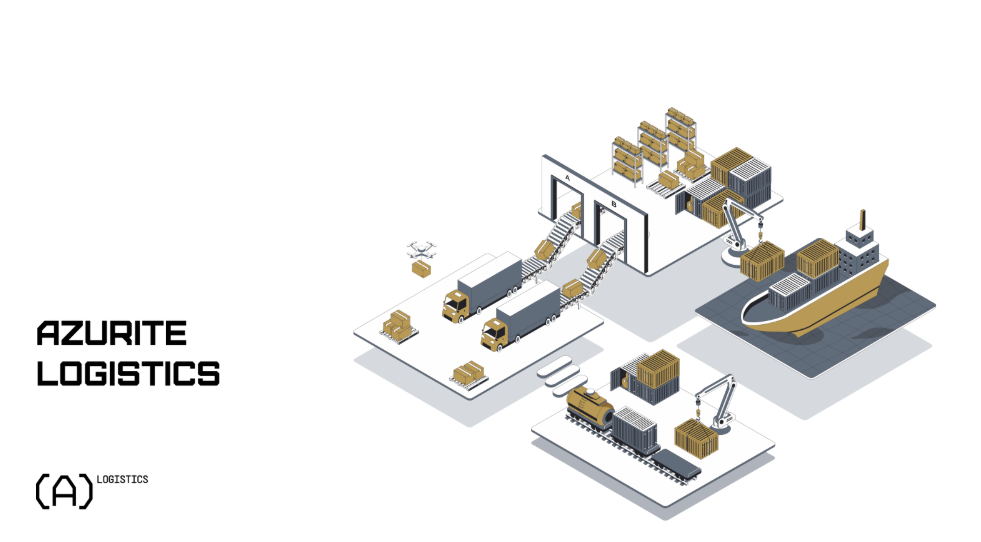

Meet the Associate | ACIK Stories: Azurite Logistics

Meet the Associate | ACIK Stories: Azurite Logistics

Meet the Associate | ACIK Stories: KZ Protection Group

Meet the Associate | ACIK Stories: KZ Protection Group

ACIK and President Marco Beretta Take Center Stage in Rome Meeting with Kazakhstan’s Minister of Foreign Affairs

ACIK and President Marco Beretta Take Center Stage in Rome Meeting with Kazakhstan’s Minister of Foreign Affairs

Meet the Associate | ACIK Stories: AER

Meet the Associate | ACIK Stories: AER

President Mattarella in Astana: A Renewed Bond with the Italian Community and Kazakhstan

President Mattarella in Astana: A Renewed Bond with the Italian Community and Kazakhstan